LAC’s Energy Interconnection Projects As A Path For Regional Integration

The article discusses existing and pending cross-border electrical interconnection projects in the Latin American and the Caribbean (LAC) region.

Cross-border electrical interconnection projects link the electrical grids of different countries enabling the creation of an electricity market for this resource, enhancing energy security and reliability. Modern interconnections increasingly focus on integrating a mix of energy sources, from petroleum to renewables, to enhance grid stability and reduce carbon emissions. The article discusses existing and pending cross-border electrical interconnection projects in the Latin American and the Caribbean (LAC) region.

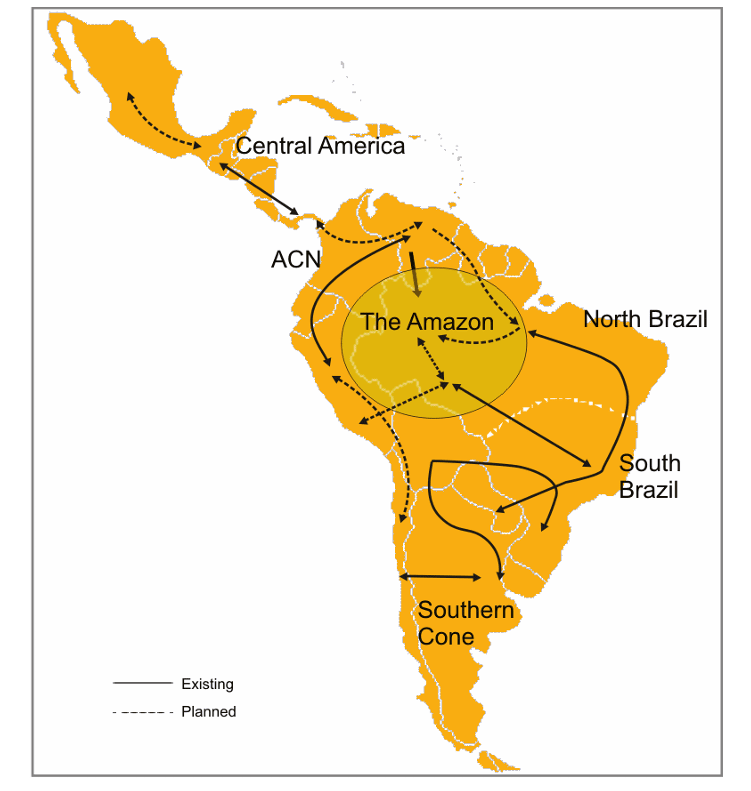

Almost every country in the LAC region has limited bilateral cross-border transmission interconnections with its immediate neighbors. Sometimes it's just two countries making these sorts of arrangements, while other times clusters of more than two countries making a deal. The main scenarios for energy integration in Latin America follow the geographic configurations that link Central America/Andean countries, Andean countries/Southern Cone/south Brazil, and Andean countries/north Brazil. In the long term, the Amazon will be interconnected with these three subsystems within the next decade.

For example, the Central American Electrical Interconnection System (SIEPAC in Spanish) is the most developed energy interconnection project in LAC dating back to 1987 when the concept of a regional electricity market was first proposed by the six Central American governments, – Guatemala, El Salvador, Honduras, Nicaragua, Costa Rica, and Panama – with encouragement from the Spanish government and Endesa. SIEPAC stands as a monumental achievement in this regard for the region, linking the power grids of those six states through a 203 kV transmission line spanning 1830 km paving the way for a unified Central American electricity market, fostering economic cooperation and reducing dependency on external energy sources. The construction of the transmission line began in the late 1990s, financed by institutions like the Inter-American Development Bank (IDB) and the Central American Bank for Economic Integration (CBEI), and was completed in 2014. SIEPAC not only improved transmission capacity but also laid the groundwork for the Regional Electricity Market (MER), which facilitates cross-border electricity trade and enhances the region's energy security. Complementing SIEPAC is the Guatemala-Mexico Interconnection, a 400 kV transmission line that extends 103 km, further integrating the region's energy infrastructure.

Now between the Andean countries, the Southern Cone and southern Brazil, there’s the Energy Integration System of the Southern Cone (SIESUR) system which includes Argentina, Brazil, Chile, Paraguay, and Uruguay. The Southern Gas Pipeline Network is also a part of this configuration, involving Argentina, Bolivia, Brazil, Chile, Paraguay, Peru, and Uruguay. While the Northern Arc — which is still just an idea — aims to connect Guyana, Suriname, French Guiana with Brazil if it were to be built. The Garabi electricity interconnection project between Brazil and Argentina became fully operational in 2000 facilitating cross-border energy trading between the two countries despite their different power system frequencies (Argentina operates at 50 Hz, while Brazil operates at 60 Hz). Additionally, Brazil's 60 Hz power is routed to Uruguay's 50 Hz system. Brazil is set to expand its electric grid over the next decade — with China’s help —, with a focus on guaranteeing rural areas access to energy.

The Andean Countries Electric Interconnection System (SINEA in Spanish), when finished, will interlink the power grids of Colombia, Bolivia, Chila y Ecuador, and Peru, facilitating the efficient distribution of electricity. Through the Connect 2022 initiative Colombia with the US have also set as goals for interconnecting Latin American country. Before 2015, Colombia functioned as a net exporter of electricity, capitalizing on its robust hydropower infrastructure, although this trade with Venezuela was abruptly terminated in May 2019 because of US sanctions. Colombia was a net electricity exporter until 2015 due to hydropower availability. Colombia has five interconnections with Ecuador and three unused with Venezuela. The U.S. Department of Energy and the Andean Electrical Interconnection System support plans for a regional project with Ecuador and Peru to create a common Andean electric power market. A 500 kV Ecuador-Peru transmission line is planned for 2024-25, enabling synchronous operation with Colombia.

The planned Panama-Colombia Interconnection aims to construct a 500-600 km HVDC transmission line, connecting Panama II with Cerromatoso in Colombia. The Panamanian National Energy Secretariat revealed that Panama and Colombia have reignited discussions on a 15-year-old binational electricity interconnection project. The two nations have scheduled a meeting for December to outline a detailed action plan for the project. The Panama-Colombia Electric Interconnection System, if it comes to completion, could enable the utilization of renewable resources across the region.

For their part Chile and Peru have reaffirmed their commitment to advancing the electrical interconnection between the two countries via the Arica-Tacna region. Studies are currently underway to assess the economic benefits of this interconnection, as stated by Chile’s Energy Minister Susana Jiménez as both countries are working on a regulatory agreement to facilitate electricity exchanges.

In the Caribbean, while no active interconnection projects exist between island countries, significant progress has been made in renewable energy deployment, supported by the U.S. through the Caribbean Energy Security Initiative. The Dominican Republic and Haiti, for instance, are exploring ways to enhance their energy security through interconnections. Dominican Republic President Luis Abinader proposed in September 2024 an ambitious plan to sell electricity to Puerto Rico through an underwater cable. The proposed $1 billion project, currently under evaluation by the U.S. Department of Energy (DOE) for a presidential permit, would involve a high-voltage direct current (HVDC) subsea transmission line with a capacity to transport up to 700 megawatts of electricity in either direction. The amount of electricity that can be sent between these countries is very small. In fact, only about 5% of all the electricity produced in the region is traded across borders. One of the key obstacles to regional electricity trade is a lack of regulatory and institutional reforms in the electricity sector to facilitate trade.

While it has been the US hitherto helped LAC develop its cross-border electric interconnections, China's arrival in the region forecasts that it will be an important part for the further development of these systems. Chinese President Xi Jinping’s endorsement the Global Energy Interconnection (GEI) in 2015 has boosted the focus and investment on these projects moving forward. China has been actively investing in Latin America and the Caribbean region, focusing on renewable energy and infrastructure projects. Chinese companies have signed engineering contracts worth over $280 billion in Latin America, with a significant portion of these investments directed towards new energy and digital infrastructure.